National Radiography of Major Company HQs: Where Corporate Power Concentrates in Spain

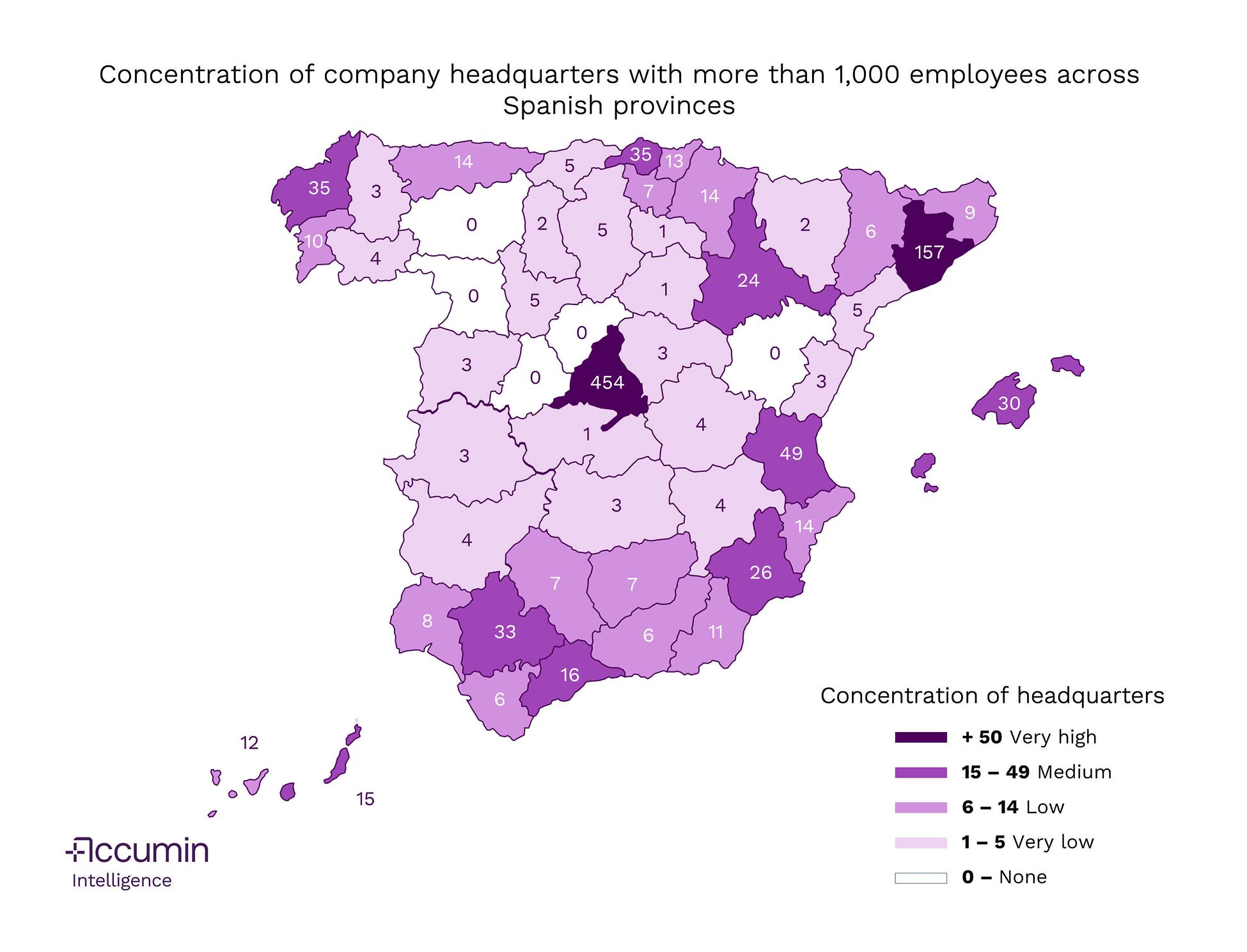

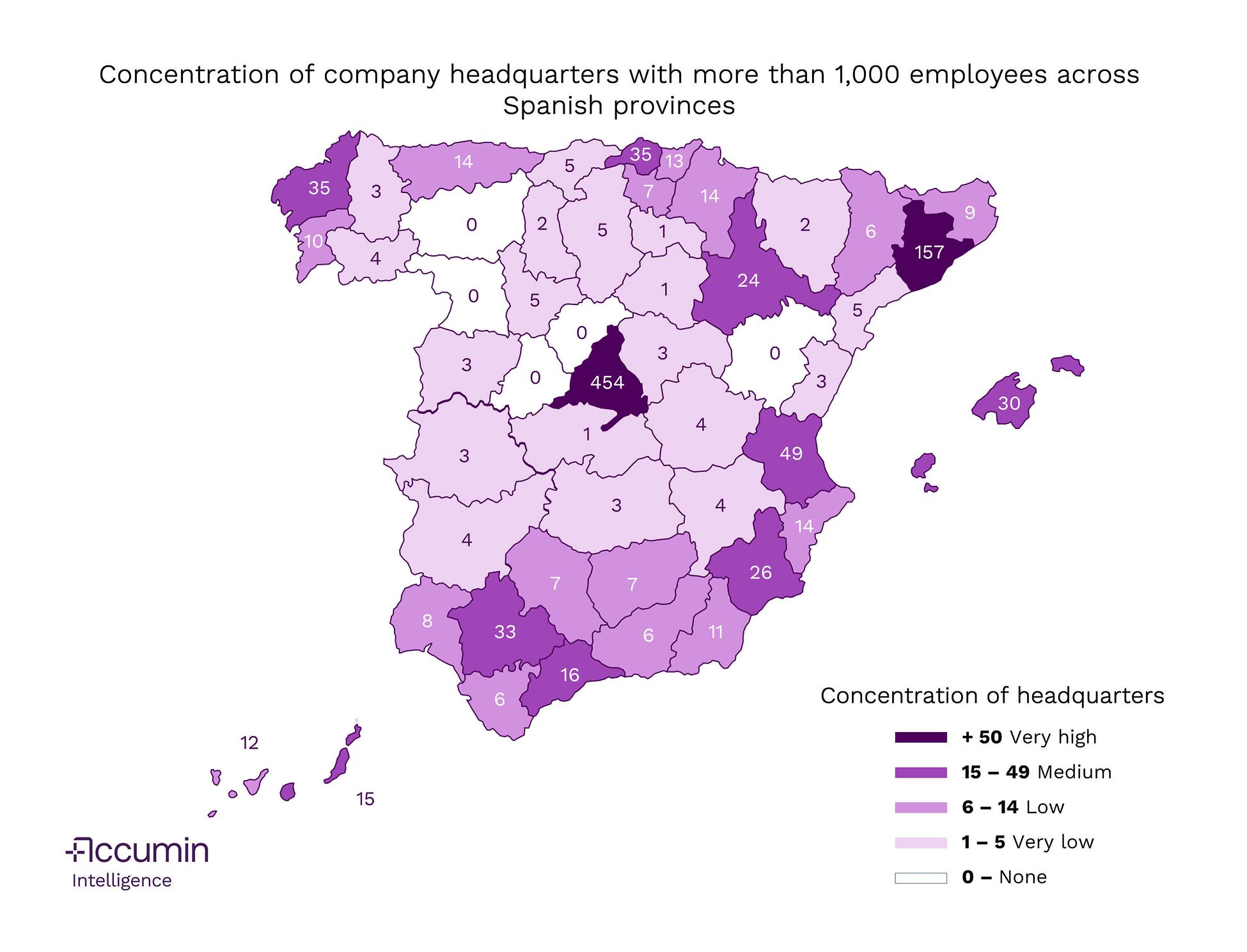

In Spain, the decisions that move hundreds of millions of euros, define global strategies and attract or repel talent are not made evenly across the territory. Our map of headquarters of Spanish companies with more than 1,000 employees by province makes it clear: corporate power is highly concentrated—and large areas of the country remain in the shadows.

This article explains what the map and the accompanying table reveal, the patterns they draw and their implications for the economy, investment and territorial development.

What You Are Really Seeing in the Map

The map and table created by Accumin Intelligence represent:

- Headquarters of Spanish companies with more than 1,000 employees.

- Distribution by province, not by autonomous community.

- Classification by levels of concentration of large-company headquarters.

In short, this map does not reflect how many companies operate in each province, but rather where major corporate decisions that shape the economy are made.

Madrid and Barcelona: The Major Centres of Corporate Gravity

The first thing that stands out when looking at the map is clear: only a small group of provinces falls into the "very high" concentration level. Within that group, two strong poles emerge:

- A major hub in central Spain, with Madrid as the principal concentrator of headquarters.

- A significant axis in the northeast, with the province of Barcelona acting as the main corporate capital of the Mediterranean arc.

These territories function as gravity centres of the Spanish corporate landscape:

- They attract headquarters of major national and international companies.

- They concentrate advanced services (finance, consulting, technology, legal services).

- They attract talent from across Spain and abroad.

Spain’s Second-Tier Powerhouses: Regional Capitals and Economic Axes

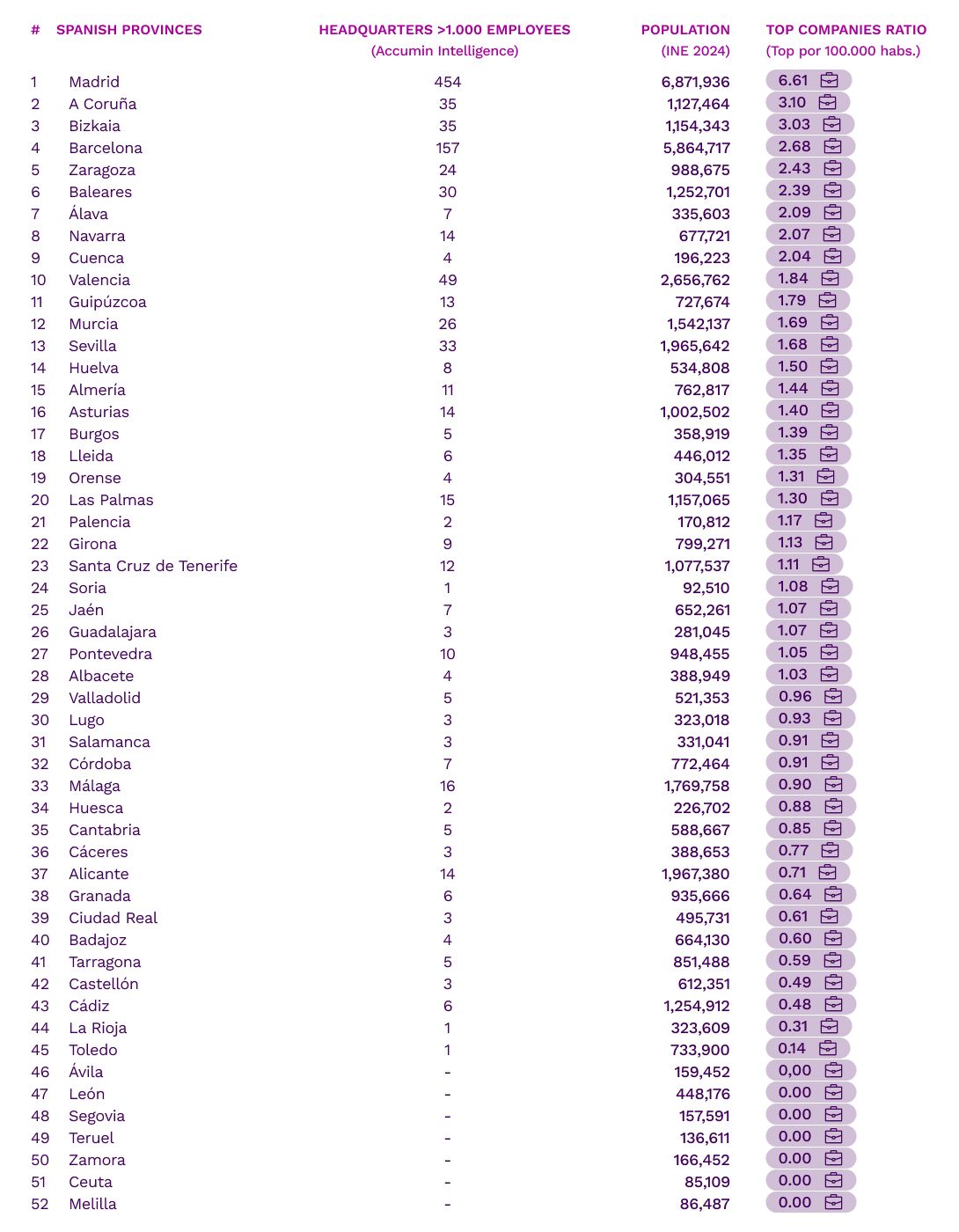

To better understand how the headquarters of the largest Spanish companies are distributed, the following table relates the number of large companies per province to its population, generating a ratio of top companies per 100,000 inhabitants:

If we analyse the ratio of large companies per 100,000 inhabitants, Bizkaia and A Coruña stand out, even surpassing Barcelona.

In provinces with between 15 and 49 headquarters, several regional capitals and coastal provinces appear with strong industrial, logistics or tourism activity.

Economic corridors also emerge, where the presence of large Spanish companies is significant—though still not comparable to the two main poles.

In these provinces, large companies play a dual role:

- Local economic anchor: sustaining qualified employment, supply chains and professional services.

- Global connector: linking peripheral territories to markets where decisions are often made in other provinces.

These territories may not lead in total headquarters, but they act as second-tier powerhouses: balancing the corporate landscape, boosting sector-specific innovation and sustaining key nodes in value chains such as automotive, energy, tourism and agri-food.

Find our Ranking of Top Companies in Spain.

A Spain of Corporate Voids: Provinces with Low or Zero Concentration

The other side of the map is equally important. The table shows that most provinces fall into:

- Very low concentration levels (1–5 headquarters), or

- Directly zero (no headquarters of Spanish companies with more than 1,000 employees).

This distribution creates a “Spain of corporate voids”, with several implications:

-

Fewer Local Decision Centres Where there are no large-company headquarters, decisions that affect local territory—closures, investments, relocations—are often made elsewhere.

-

Less Executive and Specialised Employment Lack of central services reduces the presence of highly qualified profiles, limiting talent retention and long-term demographic dynamism.

-

Lower Capacity for Influence A territory’s economic influence weakens in major corporate, financial or regulatory forums. It’s not only what is decided, but where it is decided.

This does not mean these provinces lack business activity. Many host strong SMEs, cooperatives, sector clusters or significant industrial plants. But they do not concentrate large headquarters—and that creates a structural difference in corporate power.

Corporate Power and Territory: Why This Concentration Matters

The concentration of headquarters of major Spanish companies is not just a cartographic curiosity. It has concrete implications.

Territorial Competitiveness

Provinces with a high presence of headquarters:

- Attract more investment in advanced services.

- Offer more high-value-added job opportunities.

- Tend to develop denser innovation ecosystems (startups, tech providers, industry hubs).

Provinces with low or zero concentration need targeted strategies to:

- Connect their companies better with decision-making centres.

- Specialise in niches where they can offer competitive advantages.

- Use digitalisation and remote work to attract talent and decisions without moving headquarters.

Economic and Social Cohesion

When corporate power concentrates, so do:

- Part of the tax revenues linked to these companies.

- Decisions on where to open or close centres.

- The ability to drive major public–private projects.

Spain faces a clear challenge: the country has a deficit of large companies, and this deficit is more pronounced in many territories. Public administrations and civil society must work together to leverage the strength of major hubs while ensuring no region is left behind.