Liquidity in Madrid’s real estate market: How easy is it to sell a property today and where is it easiest?

When discussing the residential market in Madrid, people tend to think about prices, returns, or location. However, there is a more direct and practical question that, in many cases, has a greater impact: how quickly can a property be sold in the city today? In other words, how liquid is Madrid's real estate market and where are properties selling like hotcakes?

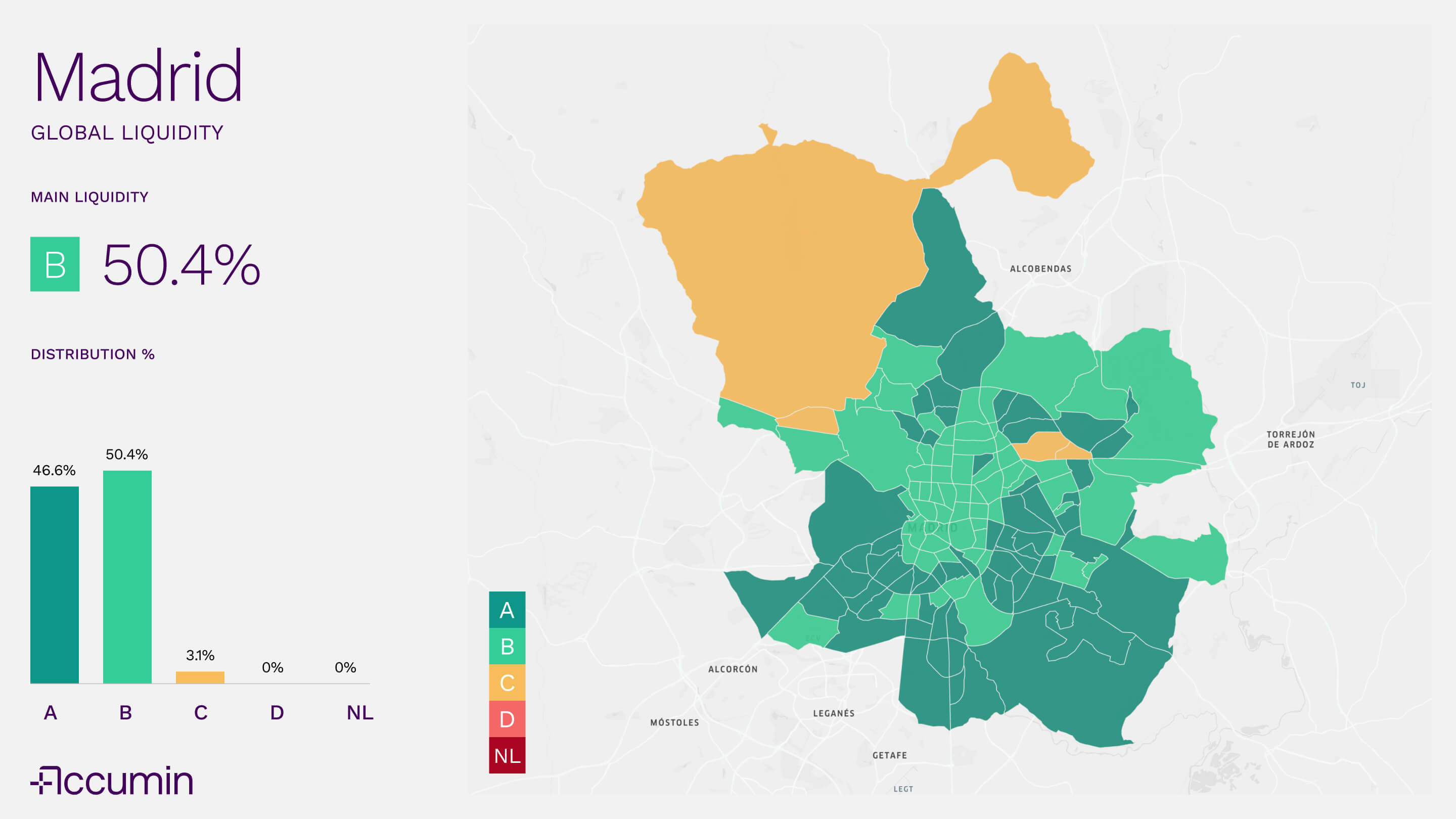

Based on data processed by Accumin Intelligence—which measures liquidity based on the time an asset is listed and delisted, along with the absorption rate of the neighbourhood—the property portfolio has been classified into five levels: **A, B, C, D and NL (non-liquid), with A being the most liquid. ** Below, we break down the main results according to three key variables: location, property size and product type.

A largely liquid market, with few geographical exceptions

Overall, Madrid has a highly liquid structure. 97% of the housing stock is classified as category A or B, indicating that most properties for sale are marketed within a reasonable time frame. 46.6% are classified as A and 50.4% as B. There are virtually no assets classified as D or NL.

However, there are some localised exceptions. The only neighbourhoods that fall to level C liquidity are El Pardo, Palomas and Piovera, peripheral areas with very specific characteristics in terms of supply and demand. In these cases, the marketing time is longer, and asset turnover is lower.

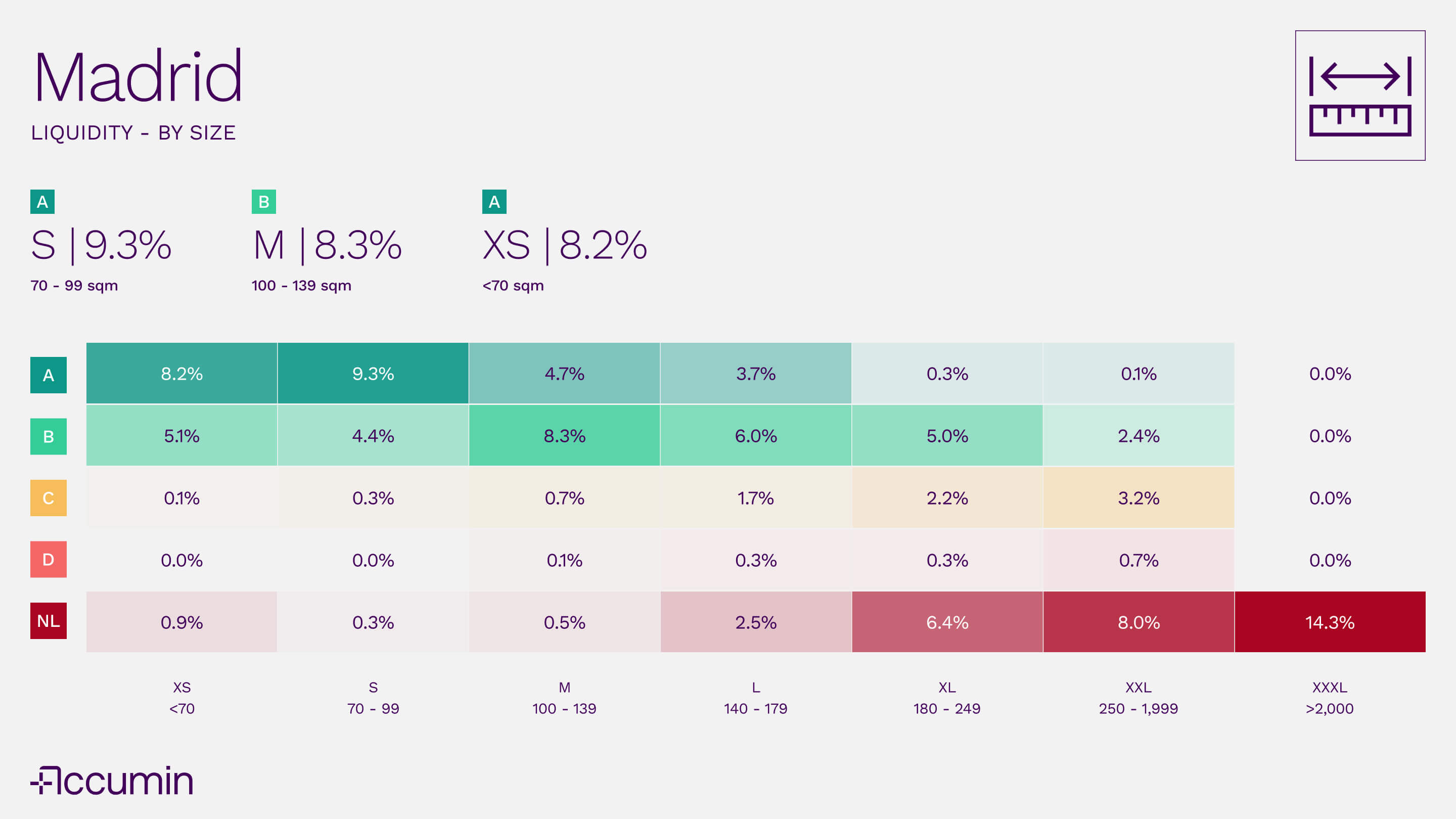

Medium-sized and compact homes are the most liquid

The size of a property directly influences its performance in the market, and the data shows a clear pattern: the most liquid homes in Madrid, in terms of volume, are those classified as S (between 70 and 99 sqm), M (100–139 sqm) and XS (less than 70 sqm). In other words, these are the segments that combine abundant supply with a high turnover rate.

In Madrid's total housing stock:

- 8.2% consists of XS-sized homes with an A liquidity rating.

- 9.3% corresponds to S dwellings with level A.

- 8.3% are M homes at level B.

Most of Madrid's residential stock is selling quickly, but not all products are performing equally well.

Overall, this means that a very significant part of the Madrid market consists of homes up to 139 sqm that sell quickly. Not only are they the most numerous, but they also have the strongest presence in the high liquidity levels.

As the surface area increases, the situation changes. Large dwellings — segments L (140–179 sqm), XL (180–249 sqm) and above — have a much lower presence in levels A and B. All dwellings larger than 2,000 sqm (category XXXL) are in level NL, i.e. without turnover, and represent 14.3% of Madrid's housing stock.

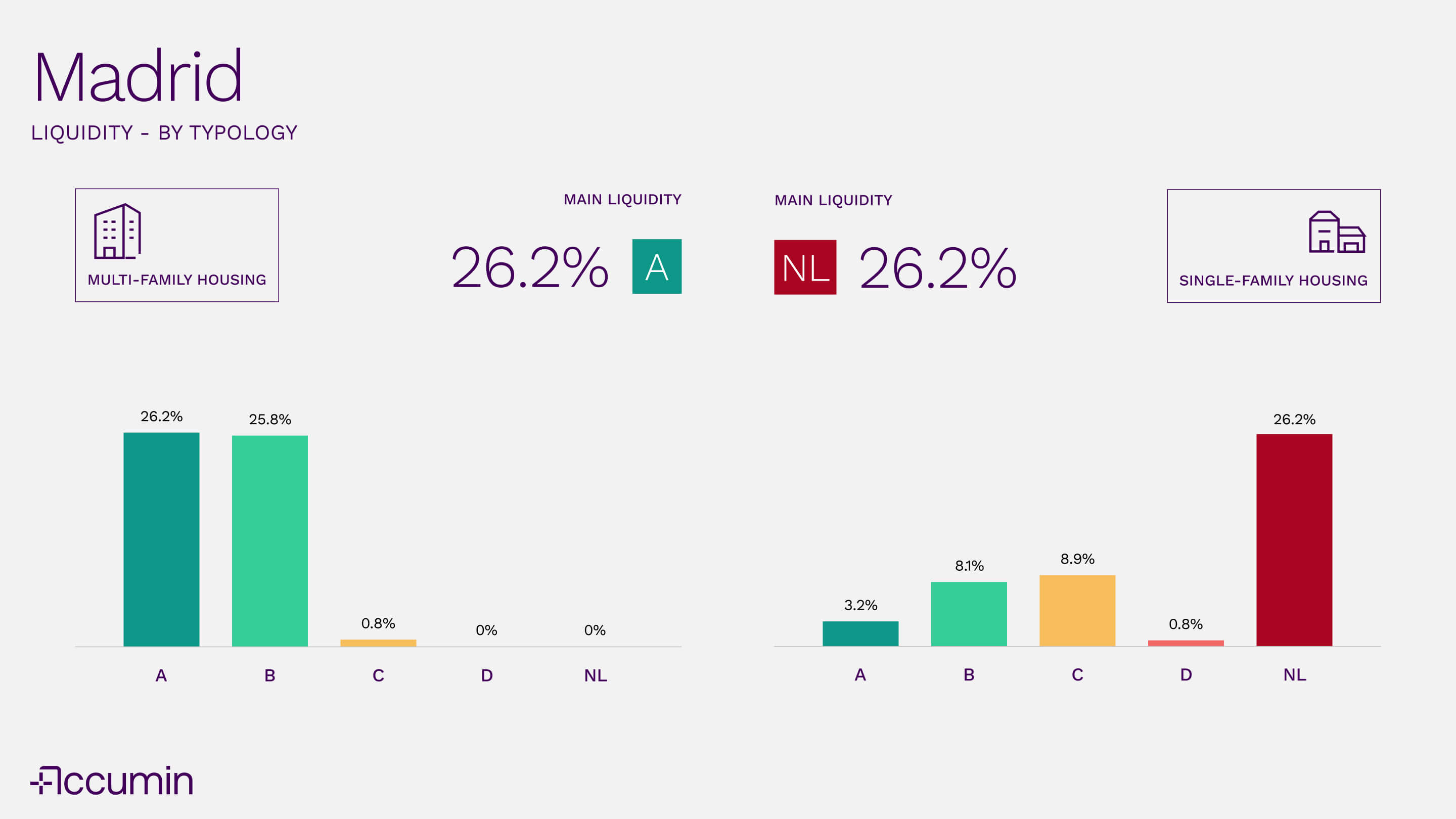

Multi-family housing accounts for most of the liquid market

The liquidity analysis carried out by Accumin Intelligence distinguishes between two main types of housing: multi-family (flats in buildings) and single-family (villas, detached houses or semi-detached houses). According to the data, of the total housing stock in Madrid:

- A 26.2% corresponds to multi-family dwelling with an A liquidity rating.

- Another 25.8% are also multi-family dwellings, but with level B.

This reflects that most of the liquid market is composed of multi-family housing.

In contrast, single-family homes present a very different profile. Although they represent a smaller volume of the housing stock, their concentration in low liquidity levels is clear. 26.2% of the total housing stock corresponds to single-family homes classified as NL, i.e., with no recent signs of coming onto the market. This figure shows much slower behaviour, with reduced turnover and longer marketing times.

Beyond prices or trendy areas, what defines the ease of selling a property in Madrid today is its ability to move within the market. The data makes it clear: most of Madrid's housing stock is highly liquid, especially in the case of medium-sized or compact flats.

Only a very small part of the market—large homes, single-family homes and certain suburban neighbourhoods—shows signs of stagnation. For owners, investors or agents in the sector, understanding these dynamics is not only useful: it is decisive when setting prices, forecasting deadlines or deciding which assets to focus on. Because knowing how much a property is worth is important but knowing how long it takes to sell is key.