How easy is it to sell a property in Valencia? We have a map by neighbourhood that shows you

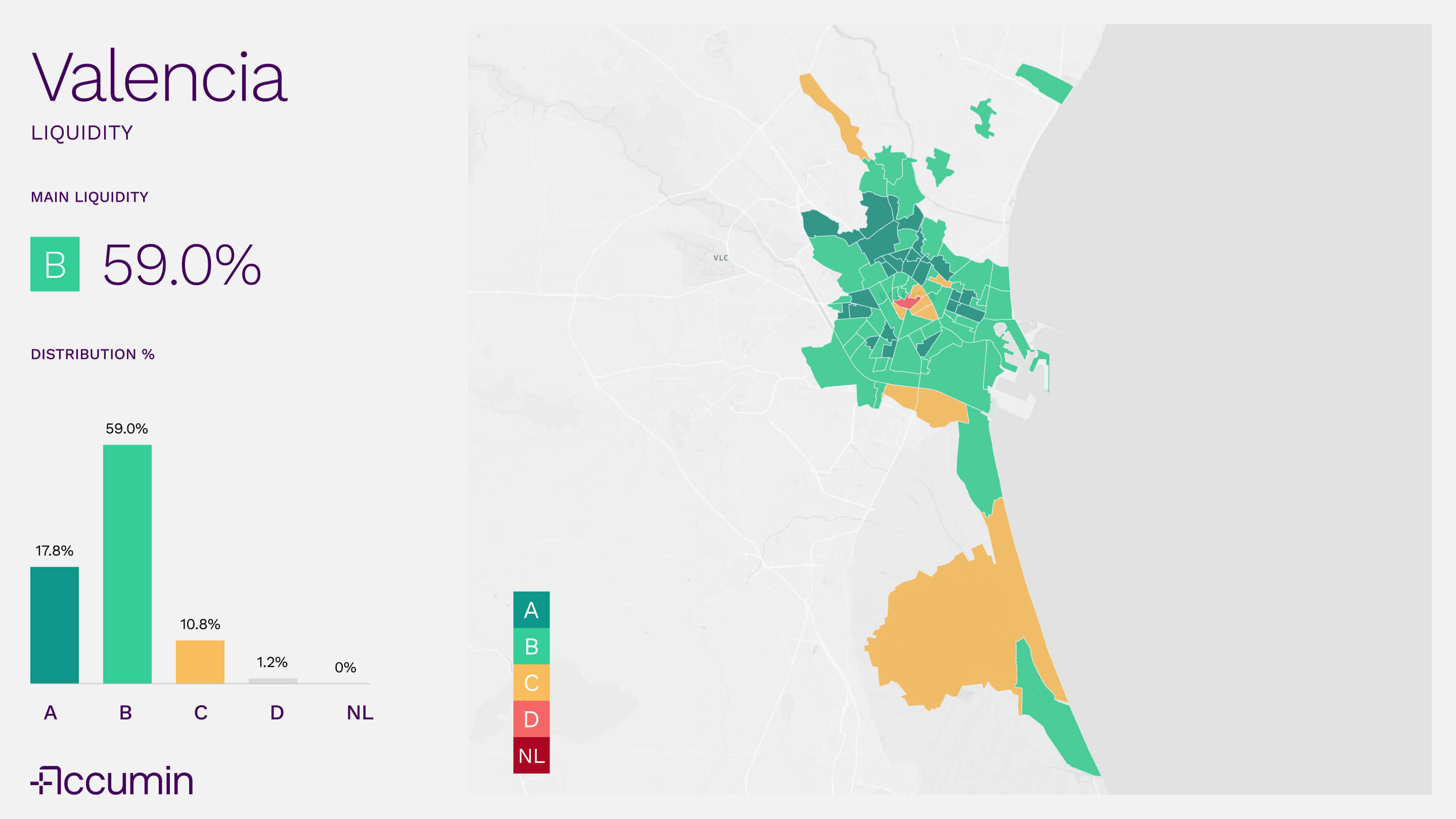

Real estate liquidity in Valencia can now be measured, visualised and compared thanks to data analysis processed by Accumin Intelligence. Based on the time it takes for a property to sell and the absorption rate in each area, we have classified the entire residential stock into five levels of liquidity: A (highly liquid), B, C, D and NL (non-liquid).

The result: a comprehensive overview of the Valencian property market, revealing which neighbourhoods, types of property and sizes sell fastest and which do not. Best of all, everything can be seen clearly and directly through our map and graphs, which show briefly how the market is really moving.

A park with extremes: highly liquid properties or properties with no turnover

Valencia shows a clear duality: there is a strong concentration of assets in the B (59%) level, followed by 17.8% in A. However, there are also pockets of lower liquidity, especially in the C level (10.8%).

The map of Valencia's neighbourhoods reveals that:

- Most of the urban parkland is located at level B, especially in central and well-connected districts.

- Some coastal and outlying neighbourhoods—Massarrojos, El Forn d'Alcedo, Castellar-l'Olivera, El Saler, and El Palmar—show levels C, indicating less dynamism in asset turnover.

We should highlight the central neighbourhoods of Benimaclet, La Roqueta, La Xerea, Pla del Remei, Gran Via and Sant Francesc, where liquidity levels C and D are recorded.

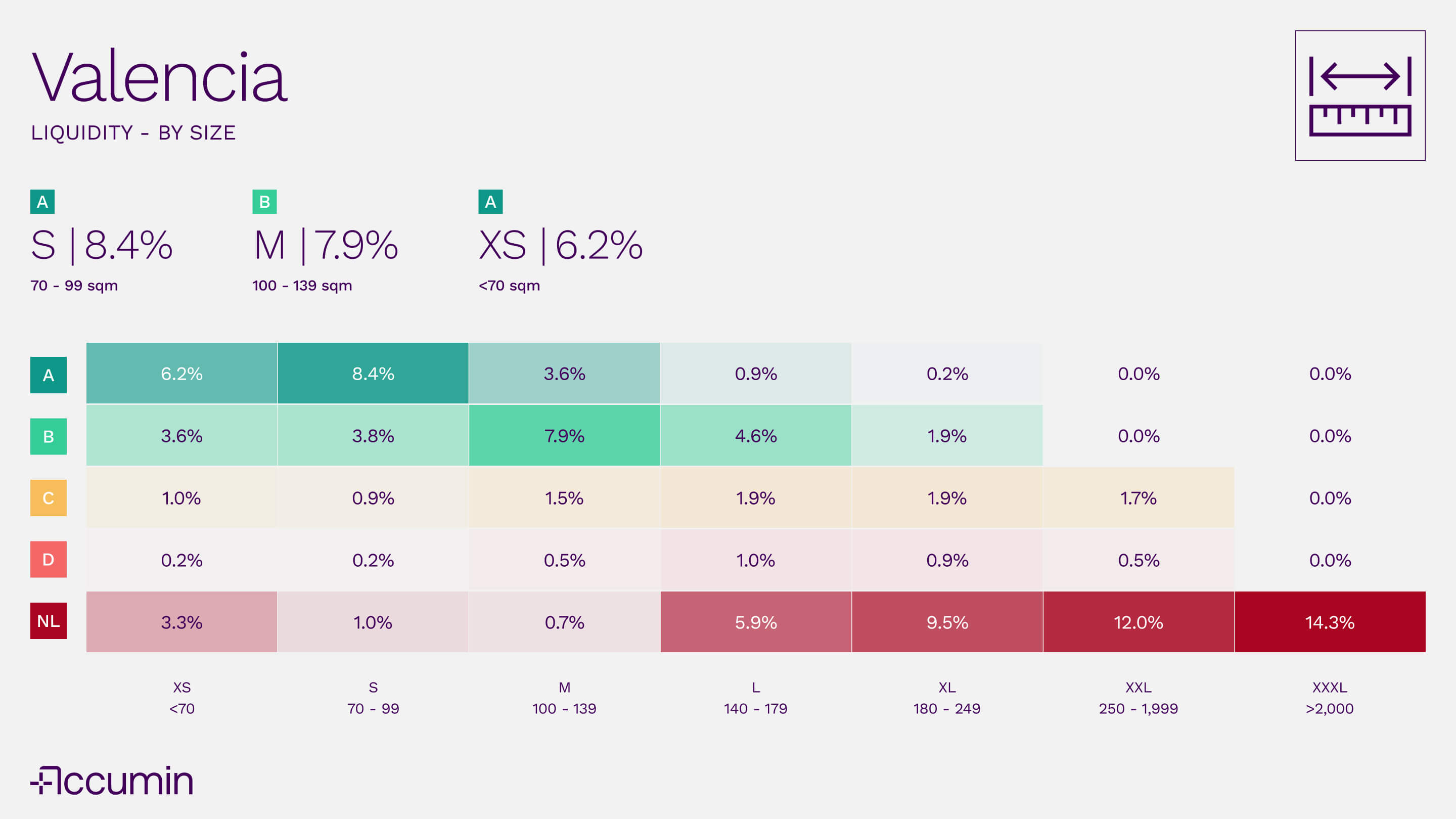

Small and medium-sized homes dominate liquidity

The size of a property is one of the most decisive factors in its ease of sale. In the case of Valencia, an analysis of liquidity by surface area reveals a clear pattern: compact and medium-sized properties sell the fastest, while large properties tend to remain on the market for longer.

- 8.4% of the total housing stock consists of S-type homes (70-99 m²) with A liquidity, making them the largest group in the most liquid segment.

- XS homes (less than 70 m²) also show positive figures: 6.2% of the housing stock is rated A, confirming the strong demand for more compact homes.

- Medium-sized homes (100–139 m²) also perform well, with 7.9% of the housing stock at level B.

As square meters increase, turnover falls. L, XL, XXL and XXXL homes have a strong presence at NL level. For example, 14.3% of the housing stock in Valencia consists of XXXL homes (over 2,000 m²) with no turnover.

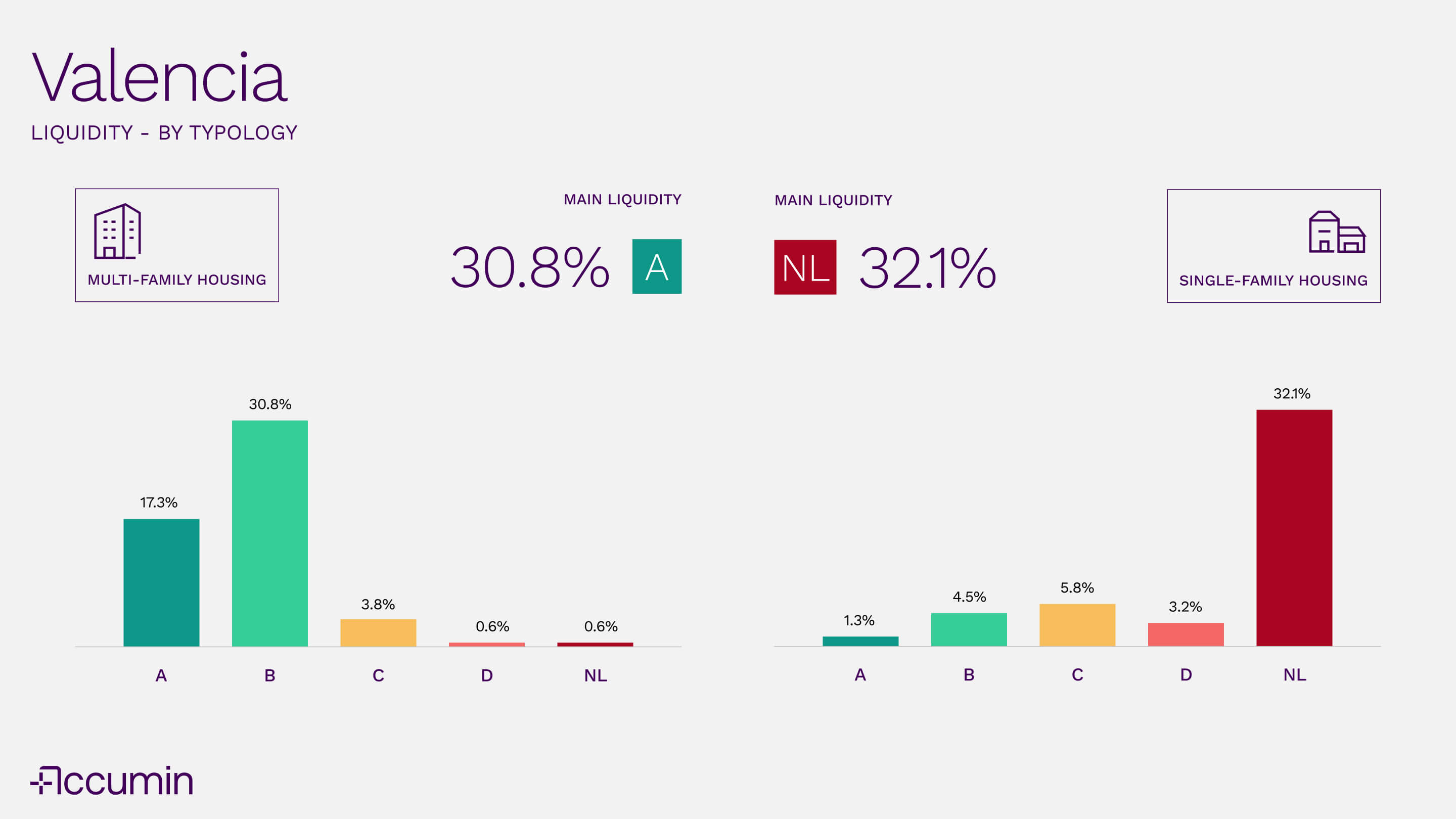

Single-family housing, the focus of illiquidity

When observing the liquidity of the property market in Valencia according to the type of housing, the contrast is striking. The segmentation between multi-family housing and single-family housing marks two very different market realities.

- 30.8% of the portfolio corresponds to multi-family housing with an A liquidity rating. These are flats in buildings, mostly well located and with high turnover.

- In addition, another 17.3% is classified as grade B, reinforcing the fact that almost half of the liquid market consists of flats in residential blocks.

The situation is very different with single-family housing.

- 32.1% of Valencia's housing stock consists of single-family homes classified as NL (non-liquid), i.e. with no recent transactions.

- Added to this are residual levels in C (5.8%) and D (3.2%), which also indicate low turnover.

This reflects a clear lack of dynamism in this segment. These are homes with a less sought-after profile, larger surface areas, often located in less dense or peripheral areas, and with less affordable prices. The result: longer selling times and a very high presence in the illiquid segment of the market.

Real estate liquidity has become a key indicator for decision-making: setting This analysis is not about prices or trendy areas. It is about something more tangible: which homes are selling, and which are not.

Thanks to data processing carried out by Accumin Intelligence, we can accurately classify all residential properties in Valencia according to their liquidity. This is not just a snapshot of the present. It is a decision-making tool.

Because in a market where selling times set the pace, understanding liquidity is key to valuing assets, designing commercial strategies or deciding where to invest.