Accumin and IESE prove the link between energy efficiency and home value in Spain

News & Events

Jan 28, 2025

Spain's largest property valuation company, Tinsa by Accumin, the data and market analytics platform Accumin Intelligence, and IESE Business School have published the first report to statistically demonstrate the impact of energy efficiency on house prices in Spain, isolating the influence of other correlated variables.

The study, 'Energy Performance and Residential Property Value in Spain', is based on a representative sample of 243,414 properties collected between 2012 and 2024. It shows that energy efficiency has a significant and positive impact on the value of homes, consistently across different regions, property types, price ranges and ages.

For each of the dwellings, the variables of energy performance certificate, surface area, age, location, construction characteristics and valuation were analysed. Using discontinuity regression design, the authors were able to isolate the specific impact of energy efficiency on house value from other correlated factors.

More efficient homes also tend to be more modern, with better construction quality and higher prices,' explains Cristina Arias, Director of the Tinsa by Accumin Research Department and one of the authors of the report. At first glance, it is difficult to distinguish whether the market places a higher value on energy-efficient properties because of their energy-efficiency characteristics, thus incorporating the value of the energy savings that the property will provide in the future, or whether, on the other hand, the higher value is due to other factors related to construction quality, which are paid for during construction or renovation and are more tangible at the time of purchase. When analysing energy efficiency, it is common to ignore these correlations, leading to misleading results.

Arias emphasises that the model captures how houses that are structurally the same, differing only in the letter of their energy certificate, have different values. The impact is therefore exclusively due to the improvement in the energy rating, isolated from the influence of other variables," he explains.

The results of this study, which includes a complete analysis of the efficiency of the Spanish housing stock by age, type or climate zone, show the existence of a 'green premium' in the Spanish housing market, where better CO₂ emission ratings translate into higher property values.

Here, the 'green premium' is defined as the percentage increase in the price of housing associated with an improvement in the energy rating of the property. This concept reflects how the market positively values properties with higher levels of energy efficiency, as they incorporate both future savings in energy costs and a contribution to environmental sustainability," says Arias.

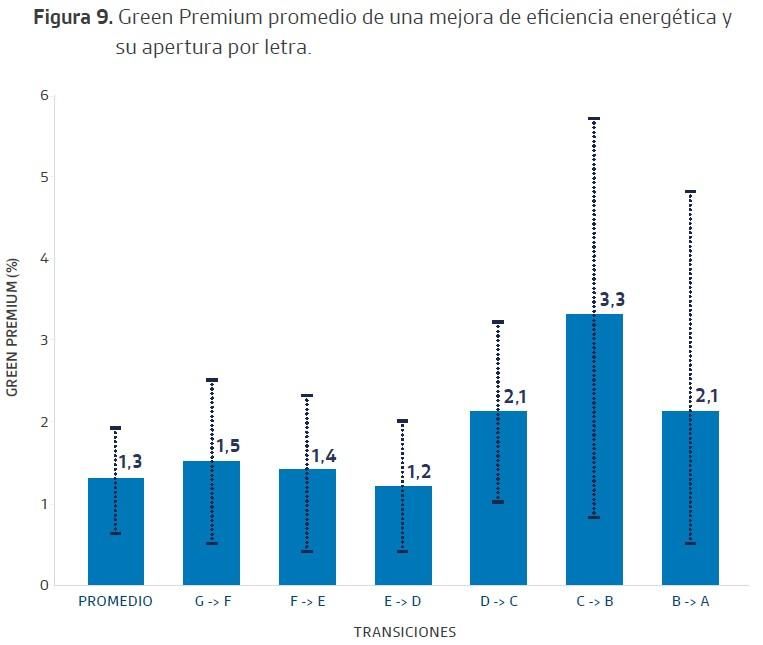

Looking at the whole sample and averaging across all letter transitions, it is estimated that a one-letter improvement in energy efficiency increases the price of a home by an average of 1.3%.

A larger impact is observed for the transitions of properties belonging to efficient categories (C-A) compared to transitions between inefficient categories (G-D). For example, there is an increase of 1.2% when moving from E to D, 2.1% when moving from B to A and up to 3.3% when moving from C to B.

'The study shows that the increase in value associated with greater energy efficiency is not limited to the higher-priced properties in the premium or luxury segment, nor to detached houses as opposed to apartment blocks, nor to specific locations, but is an attribute that is valued in all market categories,' says Arias.

Growing trend

The study concludes that energy efficiency contributes to property revaluation. Although it currently has a moderate direct impact on the value of housing, its importance is consistent across all segments, and it is positioned as a key factor in determining market prices.

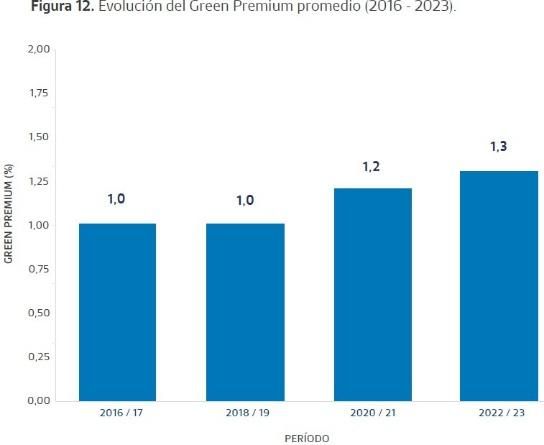

Historical analysis shows a growing trend in ‘green premium', which corresponds to a higher valuation of sustainability, due to both the environmental awareness of housing demand and the application of stricter regulations on energy efficiency.

The results suggest that we are at the beginning of an upward trend in the valuation of efficient properties and a relative devaluation of inefficient ones.

It is reasonable to expect that the importance of energy efficiency will gradually increase as stricter regulatory policies on CO₂ emissions and energy consumption are applied. For example, the introduction of more demanding European and national regulations, such as the recent EU Energy Efficiency Directive and its transposition into Spanish legislation, will force owners to invest in improving the energy performance of their properties,' says Cristina Arias.

The interaction between the operational savings generated by improvements in energy efficiency, regulatory standards and greater environmental awareness among consumers will contribute to increasing the 'green premium' in the coming years, positioning energy efficiency as a strategic factor for the future of the real estate sector, concludes the study.

About Tinsa by Accumin and Accumin Intelligence

Tinsa by Accumin is the largest company specialised in the valuation of real estate and personal assets in Spain. The company, which has the largest database of real estate assets in the country and the most extensive network of valuers, also offers real estate consultancy services in urban planning, sustainability, market analysis and feasibility studies for investment projects.

Accumin Intelligence provides insights and recommendations for the property market and other industries, based on the most extensive and carefully selected data collection, designed to facilitate and optimise decision-making. In the energy sector, Accumin Intelligence has been chosen by the Ministry for Ecological Transition and the Demographic Challenge (MITERD) to design, build and validate a unified database of energy certificates at national level.

Download the Full Report

Leave us your details to access the full report.