An overview of mortgage lending in 2024 in México

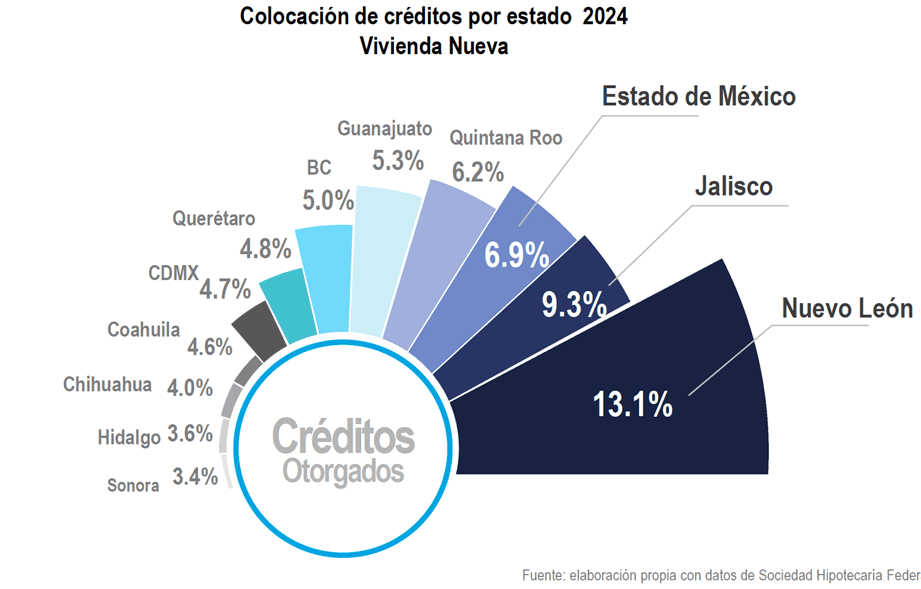

According to the analysis "Real Estate Market Outlook 2025" prepared by Tinsa Mexico by Accumin, Nuevo León led the country in mortgage loan issuance in 2024 with 13.1% of the total, followed by Jalisco (9.3%) and the State of Mexico (6.9%). The share of these three states in loan issuance was very similar to that of 2023.

The states of Quintana Roo, Guanajuato, Baja California, and Querétaro are in the following positions, leaving Mexico City in eighth place.

By type of housing, used homes have gained ground in states such as Mexico City, the State of Mexico, and Baja California Sur, where they represent more than 55% of the number of loans issued.

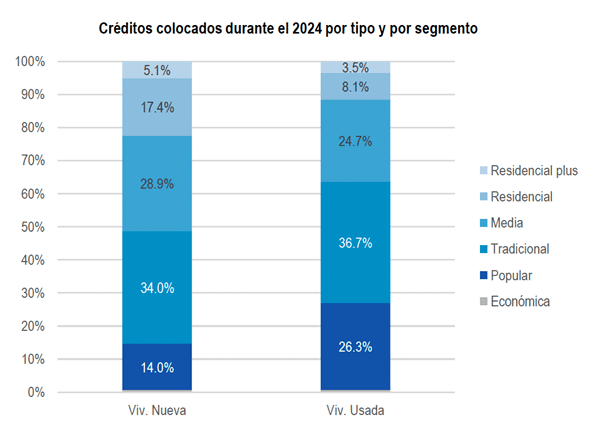

By segment, the largest percentage of mortgage loans are for traditional and mid-range housing. Second-hand property is particularly prevalent in the traditional segment, while new homes are particularly prevalent in the mid-range segment.

By age group, 42% of those who took out a loan were between 25 and 34 years old, followed by those between 35 and 44 years old at 31.1%, and those between 45 and 54 years old at 16.1%. In 2023, a similar share will be among those between 24 and 34 years old, with the participation of young people becoming a trend that stimulates demand and the type of real estate offering.

According to economic analysts, the GDP outlook for 2025 will be conservative, with a 1.0% to 1.2% growth rate, as is traditional at the start of a new six-year term, coupled with external economic and political conditions that could influence the Mexican economy.

Mortgage lending is also expected to grow conservatively with stable interest rates.

At Tinsa by Accumin, our purpose is to empower people and companies to grow by making the best decisions in a constantly evolving market. Our goal is to provide precision, clarity, innovation, and build trust with our clients, identifying opportunities and risks that might otherwise go unnoticed.